Table of Contents

They function as trusted intermediaries in between financiers, mutual fund, and other market participants, assisting in efficient and safe and secure investment tasks. In Figure 1, Individual A makes use of "Minimal Company LLC", of which Individual A is the sole beneficial owner, to hold a passion in Investment Fund A. Investment Fund A purchases real estate and monetary possessions in the form of by-products and shares in a PLC

The existing guidelines of the field and protections trading are primarily intended to safeguard present and prospective investors. They guarantee that investors recognize the dangers connected with their investments; help keep the stability of the marketplace for financial investments and safeties; and defend against fraudulence. Whether and just how mutual fund go through additional laws, for instance to deal with cash laundering, varies considerably in between territories.

Mineral Rights Companies

In contrast, the United States's AML program, as laid out in the Financial Institution Secrecy Act, does not need investment advisers of personal funds to keep AML programs. Numerous sorts of investment firm are likewise excluded, though AML requirements are in place for a lot of retail funds. At the time of composing, new guidelines were being contemplated in the US to reinforce AML requirements for private financial investment consultants.

While specialized financial investment funds that are marketed to the public go through a number of the very same needs explained above, particular kinds of specialized investment funds might likewise go through separate demands. Scholarship plans are mutual fund made to promote cost savings for future education within a registered education and learning cost savings strategy.

These funds are created to promote financial investments in smaller business.

The majority of REITs run along an uncomplicated and quickly easy to understand company version: By leasing room and collecting lease on its property, the company creates income which is then paid out to shareholders in the form of dividends. REITs must pay out at the very least 90% of their taxable revenue to shareholdersand most pay 100%.

Investment Firms servicing Mission

REITs traditionally have supplied competitive complete returns, based upon high, consistent returns income and long-lasting funding admiration. Their relatively reduced relationship with various other properties also makes them an excellent portfolio diversifier that can help in reducing overall profile threat and rise returns. These are the attributes of REIT-based genuine estate investment.

An official web site of the United States government. If you intend to request a bigger IP range, initial request access for your present IP, and after that make use of the "Site Feedback" button discovered in the reduced left-hand side to make the demand.

The essential usual facets of UCITS funds are that they must be flexible and fluid. The exibility of UCITS is evident because they may be established as a single fund or as an umbrella fund that is comprised of a number of ring-fenced sub-funds, each with a different financial investment goal and policy.

Administration of each sub-fund can be performed by a different financial investment manager and sub-funds are permitted to invest in each various other, subject to certain investment restrictions. UCITS funds can be made use of for a vast array of methods and property classes. Exchange Traded Funds (ETFs) and Money Market Funds (MMFs) are generally established at UCITS funds.

Investment Company in Mission

An ETF might be developed as a UCITS or an AIF. Most ETFs in Ireland have actually been set up under the UCITS regime, therefore benetting from the high degree of acceptance of UCITS by regulatory authorities and capitalists worldwide due to the financial investment policies, capitalist securities and take the chance of administration safeguards given under the UCITS structure.

The Qualifying Investor AIF is a controlled mutual fund appropriate for educated and expert investors. As the QIAIF is not subject to any type of financial investment or loaning restrictions, it can be made use of for the widest variety of investment purposes. The Retail Financier AIF has changed the previous non-UCITS retail regime with an extra adaptable structure.

In addition, with retail capitalist protection in mind, the Reserve bank has stated that a RIAIF might just have a totally authorized AIFM. Non-EU supervisors (that do not have a completely authorized, EU-based AIFM) and sub-threshold AIFMs are for that reason prevented from managing a RIAIF.Legal Structures Firms are registered under a collection of Acts called the Companies Acts.

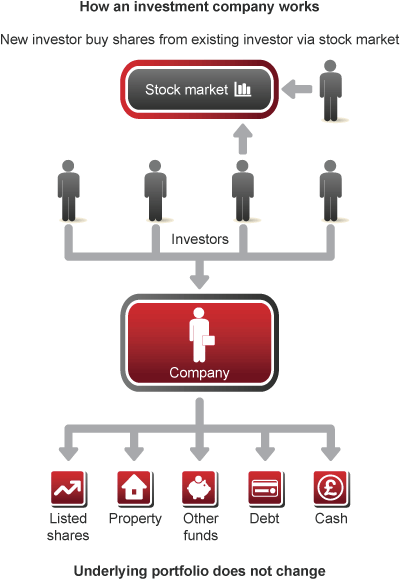

The major purpose of funds established up as investment firm is the cumulative financial investment of its funds and building with the goal of spreading financial investment danger. A firm is taken care of for the advantage of its shareholders. Variable capital firms can buy their own shares and their released share capital must whatsoever times amount to the internet asset value of the underlying possessions.

The ICAV is a new business vehicle designed particularly for Irish mutual fund, it rests along with the public minimal firm (plc), and offers a custom-made corporate fund lorry for both UCITS and AIFs. It is not impacted by modifications to particular pieces of business legislation that are targeted at trading business.

Investment Management servicing Mission

The purpose of the automobile is to reduce the management complexity and expense of developing and keeping cumulative investment plans in Ireland. For additional information on ICAV registration please see theCBI internet site. Device Trust fund is a legal fund structure comprised by a trust deed between a trustee and a management business (supervisor) under the System Trusts Act, 1990.

A different monitoring company is constantly needed and managerial obligation relaxes with the board of directors of the management firm. The count on action is the main lawful paper which constitutes the depend on and it establishes out the various legal rights and responsibilities of the trustee, the monitoring company and the unit owners.

Navigation

Latest Posts

Landscape Design local to Mission, Texas

Investment Company local to Mission

Investment Management servicing Mission