Table of Contents

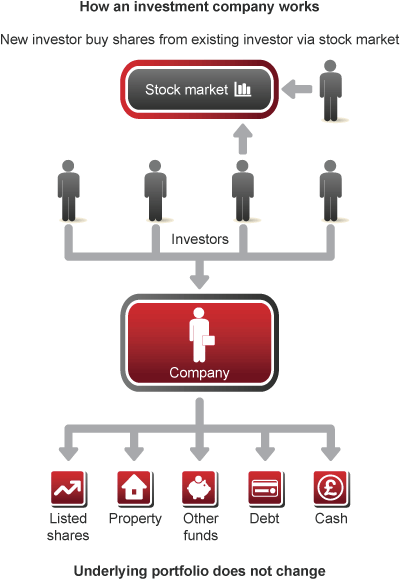

Banks An investment firm is a financial organization principally took part in holding, taking care of and investing safeties. These business in the United States are managed by the United State Stocks and Exchange Compensation and need to be signed up under the Financial Investment Business Act of 1940. Investment firm invest cash in support of their customers who, in return, share in the revenues and losses.

Financial investment companies do not consist of brokerage companies, insurance provider, or banks. In USA securities policy, there go to the very least five kinds of financial investment firms: In basic, each of these investment firm must sign up under the Securities Act of 1933 and the Investment Firm Act of 1940. A fourth and lesser-known kind of financial investment firm under the Investment Firm Act of 1940 is a Face-Amount Certification Firm.

A major type of firm not covered under the Investment Firm Act 1940 is personal financial investment firms, which are merely personal firms that make financial investments in supplies or bonds, yet are restricted to under 250 investors and are not managed by the SEC. These funds are commonly composed of really well-off investors.

This gives particular securities and oversight for investors. Managed funds normally have constraints on the types and quantities of financial investments the fund manager can make. Commonly, managed funds might only buy listed safety and securities and no greater than 5% of the fund may be bought a single safety and security. The bulk of investment firm are shared funds, both in regards to number of funds and assets under monitoring.

Investment Management

The initial financial investment trust funds were developed in Europe in the late 1700s by a Dutch trader who desired to allow tiny capitalists to merge their funds and diversify. This is where the concept of investment firm come from, as stated by K. Geert Rouwenhorst. In the 1800s in England, "investment pooling" emerged with trust funds that appeared like modern financial investment funds in structure.

Brand-new protections laws in the 1930s like the 1933 Securities Act recovered investor self-confidence.

In 1938, it licensed the production of self-regulatory companies like FINRA to manage broker-dealers. The Stocks Act of 1933 needs public securities offerings, including of investment firm shares, to be signed up. It additionally mandates that financiers obtain a current prospectus explaining the fund. "Financial investment Business". U.S. Securities and Exchange Payment (SEC).

Investment Management in Mission, Texas

Lemke, Lins and Smith, Policy of Investment Business, 4.01 (Matthew Bender, 2016 ed.). Chaudhry, Sayan; Kulkarni, Chinmay (2021-06-28). "Layout Patterns of Spending Applications and Their Impacts on Spending Behaviors". ACM. pp. 777788. doi:10.1145/ 3461778.3462008. ISBN 978-1-4503-8476-6. "Financial investment Clubs and the SEC",, Modified January 16, 2013. (PDF). Investment Firm Institute. 2023.

In retail mutual fund, thousands of financiers might be included through middlemans, and they may have little or no control of the fund's activities or knowledge regarding the identifications of other investors. The prospective variety of financiers in a private investment fund is usually smaller than retail funds. Exclusive investment funds tend to target high-net-worth people, including politically exposed individuals, and fund managers might have a close partnership with their client investors.

Easy funds have actually been expanding in their market share, and in some territories they hold a considerable portion of ownership in openly traded firms. There are various classifications for investment funds. Some are closed-end, implying they have a set number of shares or resources, whilst others are open-end, indicating they can grow right into unlimited shares or funding.

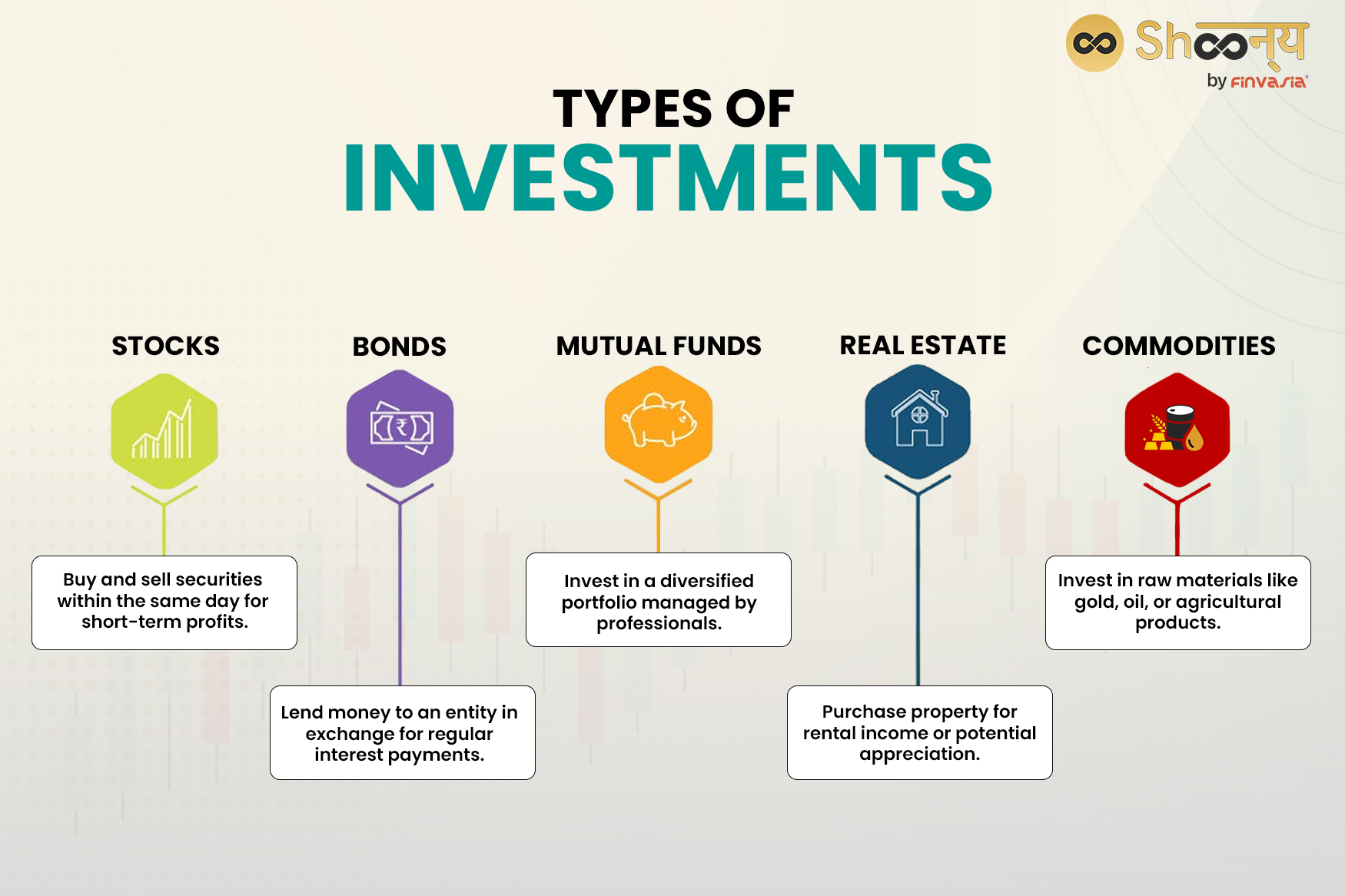

The pricing, threat, and terms of by-products are based on an underlying possession, and they enable financiers to hedge a position, increase leverage, or hypothesize on a property's modification in value. For example, a capitalist may possess both a stock and an alternative on the exact same supply that allows them to sell it at a set rate; for that reason, if the stock's price drops, the option still retains value, reducing the capitalist's losses.

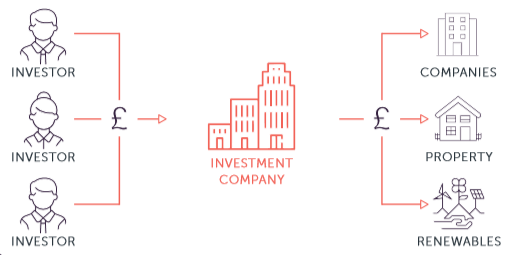

Whilst considered, provided the focus of this rundown on the robot of company lorries, a full therapy of the valuable possession of assets is outside its scope. A mutual fund acts as a conduit to gain from one or even more possessions being held as investments. Financiers can be people, corporate vehicles, or institutions, and there are normally a variety of intermediaries between the capitalist and mutual fund as well as between the investment fund and the underlying financial properties, especially if the fund's units are exchange-traded (Box 1).

Investment Company local to Mission, Texas

Relying on its legal kind and structure, the individuals working out control of a mutual fund itself can differ from the individuals who possess and gain from the underlying properties being held by the fund at any offered time, either straight or indirectly. Both retail and personal mutual fund usually have fund supervisors or consultants that make financial investment choices for the fund, selecting securities that align with the fund's goals and risk tolerance.

and serve as middlemans in between financiers and the fund, promoting the acquiring and marketing of fund shares. They link capitalists with the fund's shares and execute professions on their behalf. take care of the enrollment and transfer of fund shares, maintaining a record of investors, processing ownership changes, and releasing proxy materials for investor conferences.

Navigation

Latest Posts

Landscape Designer in Mission

Landscape Designer around Mission

Landscape Design Services